Car Rental Industry: Growth Statistics, Trends, Business Ideas & Future Opportunities

The car rental industry is proliferating globally with impressive market projections and trends. As rental is also the most flexible vehicle ownership model available in the market, the car rental industry is densely saturated with numerous offline and online players dedicated to fulfilling diverse consumer requirements. Some of the car rental business models that have already entered and dominated the shared mobility market are P2P car rental marketplace, B2B rental platforms, car rental subscriptions, and e-hailing or car-sharing services.

Interested entrepreneurs can venture into any of these models. However, to fully understand the industry and capitalize on the same, thorough market research is inevitably important. While you can rely on market research players to procure in-depth region-specific reports, we bring this complied report to help you understand the car rental industry in a better way before deciding to enter or expand your existing car rental venture.

Table Of Contents

Revving Up Globally: Car Rental Industry Overview

To get an overview of the overall market size and scope of business in the car rental industry, let’s begin with market statistics and key growth factors.

Car Rental Industry Statistics

- The global car rental industry is worth $102.50 billion in 2024.

- Its projected growth rate in the period 2024-2028 is 3.14%, denoting a massive growth of $14.50 billion.

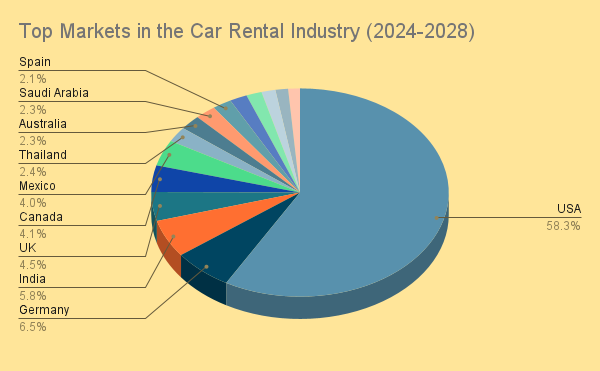

- The top growing markets for launching a car rental business are the USA, Germany, India, the UK, Canada, and Mexico.

- The current user penetration rate in the industry is 7.3% and is expected to reach 8.1% by the end of 2024.

- Rental is also the most preferred EV adoption method with a preference of 78%.

- Short-term car rentals capture 70% of the entire market share.

- According to a survey, 53% of car rental businesses are looking forward to expanding their rental fleet in 2024.

- As per Statista, 73% of all car rental revenue will be generated from online channels by 2028.

- There are 3362 car rental companies in the US alone serving up to an estimated 48 million users.

- In 2024, the number of rented cars in the US will likely be 3 times higher than in 2020 with an estimated 46.8 million.

- In the year 2023, the US car rental market reported a record-breaking revenue generation of $38.3 billion.

- As per McKinsey, the European car rental market is witnessing an upward trend and is projected to reach $161 billion – $215 billion in 2030.

- The overall car rental market size in Germany is $3.42 billion

- The Middle East car rental market is projecting an impressive growth rate of $10.42% in the period 2024-2029.

- The car rental industry in Asia has a CAGR of 6.08% in the period 2023-2028.

Key Growth Factors in the Car Rental Industry

- The Rise of Online Car Rental Platforms: The penetration of the internet paved the way for the emergence of numerous online car rental services, which are also the primary growth drivers in the car rental industry.

- Increase in Travel and Tourism: In the past decade, there has been a rapid increase in travel and tourism sectors as well, despite the setback of the COVID-19 pandemic. Travelers are looking for more reliable and quality travel services, which has led to growth in the car rental industry.

- Corporate Trips: Leisure trips and business trips are the primary growth drivers in the B2B sector of the car rental industry. The business travel market has a reported CAGR of 13.3% in the period 2021-2030.

- Short-term Rentals: Short-term rentals, with the rental period lasting for a day or two, or just spanning over the weekend have become a dominating trend, particularly in the working-class target audience.

- Convenience: Rental cars are available on an on-demand basis and thus are highly flexible. They can be easily booked in advance through online platforms or at a local store. This and the reduced maintenance troubles make the car rental option highly convenient for customers.

- Increase in Disposable Income: Due to increased disposable income, consumers can now plan more leisure trips and activities. This has positively influenced the global car rental industry.

- The Gen Z Mindset: Compared to previous generations, the Gen Z population vastly prefers rental car subscriptions over purchasing. Rental subscriptions have lower maintenance than ownership and also provide flexibility to customers.

- Political and Environmental Factors: In certain markets, such as Asia, governments have introduced various types of restrictions on the purchase of vehicles to control pollution and traffic-related problems. The preference for rental vehicles has increased in these regions.

- Development of EV Infrastructure: The development of EV infrastructure, such as charging stations and battery swapping stations is positively impacting EV rentals.

Enter the Car Rental Industry with a Tried and Tested Software

Trends and Technological Advancements

- The modern car rental industry is dominated by luxury cars, executive cars, economy cars, SUVs, and MUVs with major applications being local traveling, airport transport, inter-state transport, and general recreation.

- SUVs are the highest-demanded cars in rental, securing the highest CAGR of 11.5% in the forecast period 2023-2030.

- As per reports, bringing families on corporate trips is becoming more acceptable throughout the globe, increasing the business potential in launching a B2B car rental platform.

- Post-pandemic, the practice of following proper hygiene standards in rental cars, such as providing fully disinfected cars and hand sanitizers has continued in the 2020s.

- Automatic driving technologies, such as ADAS and cruise control are also gaining popularity in the car rental industry.

- Some other top demanded features in rental cars are heated seats, 360-degree camera, panoramic sunroof, connected car tech, head-up displays, blindspot monitoring, and lane departure warning.

- Eco-friendly fuel options are gaining prominence in the car rental industry, with an increasing preference for EVs and flex-fuel.

- The global expansion of the EV infrastructure is encouraging more and more customers to rent EVs.

- Many car rental companies are also integrating external GPS systems and remote kill switches in their cars to protect them from theft.

- Payment gateways with the lapse payment option are gaining popularity amongst car rental businesses. These gateways can hold a security amount for weeks before releasing it to customers, providing car rental companies with enough time to inspect for damages or receive any traffic challans.

- Subscription-based car rental services that provide customers with multiple rental car options in exchange for a monthly fee have also emerged in the industry.

- Wedding photoshoots, music video recording, and movie production are some of the top use cases for luxury car rentals and sports car rentals.

- Large events, such as international conferences, summits, and sports tournaments, (for example, COP summits and FIFA World Cup) also require a large number of rental executive cars.

Top Players in the Car Rental Industry

Although many online and local players are available in the car rental industry, it is predominantly dominated by the following players.

| Player | Founder | Fleet Size | Estimated Annual Revenue |

| Enterprise Rent-a-Car | Jack Crawford Taylor | 2.1 million | $35 billion |

| Budget Car Rentals | Morris Mirkin | 655,000+ (Shared with Avis) | $3.5 billion |

| Avis | Warren Avis | 655,000+ | $3.5 billion |

| Hertz | Walter L. Jacobs | 540,000+ | $2.1 billion |

| Alamo | Michael S. Egan | 225,000+ | $2.3 billion |

| Europcar | Raoul-Louis Mattei | 43,000+ | $ 1.5 billion |

| Dollar | Henry Caruso | 200,000+ (Shared with Thrifty) | NA |

| Thrifty | Walter Chrysler | 200,000 | $350 million |

| Turo | Shelby Clark | 350,000 | $746.6 million |

| Sixt | Martin Sixt | 136,500+ | $3.8 billion |

Build a Car Rental Platform like Enterprise, Avis, and Turo

Funds Raised by Startups in the Car Rental Industry

To appropriately highlight the funding scenario in the car rental industry, we have shortlisted major investments from recent years. These investments prove that the industry is welcoming new startups, and with the financial aid and guidance of investors, it is highly possible to establish your name in the industry.

- FINN: US and Germany-based car rental subscription company, FINN secured $110 million in Series C funding in 2024.

- HyreCar: US-based HyreCar rental platform raised $12.25 million in 2023

- Kyte: Car rental app Kyte secured $60 million in Series B funding in 2022.

- Dishangtie: China-based car rental business, Dishangtie completed $200 million in Series D funding in early 2022, with Ikea being one of its investors.

- Virtuo, a France-based car rental company has raised a total of $172 million with $96 million being their highest funding round.

- MILES Mobility: Germany-based MILES Mobility raised $5.68 million in two rounds of funding.

- QEEQ: A car rental startup that received funding from Alibaba Group in 2022.

- Cluno: Germany-based car rental subscription startup Cluno raised $28 million in Series B funding.

- IndusGo: India-based car rental startup, IndusGo secured $12 million in funding for fleet expansion in 2022.

- Invygo, a Middle-East car rental subscription startup, raised $10 million in Series A funding.

- Hopper, a Canada-based travel service startup raised $170 million in 2021.

- Bipi, a Spanish car rental subscription startup, raised $29.94 million in 6 rounds of funding.

- Roadsurfer, a Germany-based RV rental startup raised $28.6 million in funding

- PaulCamper, another Germany-based RV rental startup, raised $12.70 million.

- GoMore, a Denmark-based P2P car rental startup raised a total of $18.2 million in multiple rounds.

- FlexClub, a car rental subscription platform operating in South Africa, raised $6.2 million in two rounds of funding.

- Revv, an India-based car rental subscription company raised $31.2 million in seven rounds.

- Huizuche, a Chinese car rental service, raised $40 million in 3 rounds.

Improve your Chances of Funding with Robust Rental Technology

Future Opportunities in the Car Rental Industry

Based on our evaluation of the aforementioned insights, the following opportunities open up for new entrants and founders.

- Considering the impressive market size of the US, Germany, India, the UK, Canada, and Mexico, it is safest to launch a car rental business in these countries.

- The demand for airport transportation is increasing in the car rental industry, a specific business can be launched to target this segment.

- Currently, only Turo follows the P2P model in the top 10 emerging car rental companies. Due to low competition, a competitive edge can be gained in the P2P car rental sector.

- With SUVs being the most popular rental car, having a fleet inclusive of SUVs may increase the profitability of your business. However, having a diverse fleet of various types of vehicles will help cover a wider target market.

- As online channels are expected to generate 73% of the entire revenue by 2028, taking the digital route to market can prove to be more beneficial for founders.

- Eco-friendly fuel options, such as EV and flex-fuel are gradually gaining prominence in the industry.

- Due to political and environmental factors, the EV rental industry is expected to receive a boost.

- The car rental subscription model is gaining popularity amongst the Gen Z population including both working professionals and students. It also has comparatively less competition than other car rental models.

- Along with renting out cars, businesses can also generate revenue by selling add-on services such as extra miles, free parking, driver services, cool boxes, child seats, dash cams, etc.

- Car rental businesses can primarily benefit from perpetually licensed car rental software in the long term, saving them thousands of dollars in comparison to subscription-based solutions.

Conclusion

With the aforementioned insights, the car rental industry will undoubtedly expand into the future, capturing more market share and venturing into diverse business models. To help you enter the car rental industry, Yo!Rent is an ideal rental solution. It can help you build your online P2P, B2C, or subscription-based car rental platform where you can accept 24/7 booking. Additionally, you get agreement management, document verification, and rental security management options to streamline business operations. Lastly, as Yo!Rent is available at a one-time cost and is self-hosted, it comes with unlimited listings and transactions so that you can expand your business as much as you want. For more information about YoRent, book a personalized demo with our experts.